Friday, December 12, 2025

Visibility to Pipeline Scorecard CEOs Trust

From Visibility to Pipeline: A Simple Scorecard the CEO Will Believe

CEOs fund pipeline and revenue, not pageviews. A simple scorecard connects visibility metrics to dollars with clear math.

Resource-constrained teams feel this tension every week. You track traffic, impressions, and engagement. Your CEO asks one question: how many deals closed? A shared scorecard turns that anxiety into alignment by linking every activity to pipeline impact.

This post gives you a plug-and-play framework you can use today. It shows what to track, how to calculate each metric, and how to present results executives trust. You will see how 10,000 visits turn into $200,000 in pipeline with three conversion rates and one deal size.

The system uses three layers: leading indicators, conversion metrics, and lagging revenue. It requires simple attribution only. You can build it in a spreadsheet, your CRM, or an automation platform like Agent Berlin that updates and learns weekly. The goal is not perfect data. The goal is consistent, comparable numbers that drive action.

Why Marketing Teams Struggle to Prove ROI to Executive Leadership

Marketing teams struggle to prove ROI because they report activity while executives buy outcomes. Activity lacks business context.

Executives live in pipeline, bookings, and payback. Marketing reports often stop at traffic or engagement. This creates a translation gap that erodes trust and budgets. The fix is a single view that traces a line from visit to revenue with simple math.

Small teams also drown in tools. Analytics, SEO, CRM, and ads data live in silos. That fragmentation makes coherent storytelling hard. A unified scorecard consolidates signals and focuses on conversion steps that matter.

Time horizons differ too. Marketing compounds over months. Leadership manages cash this quarter. A layered scorecard solves this by pairing fast-moving leading indicators with slower revenue outcomes. It lets you say, “Green on inputs this week. Revenue follows in eight weeks,” with evidence.

What Is a Visibility-to-Pipeline Scorecard?

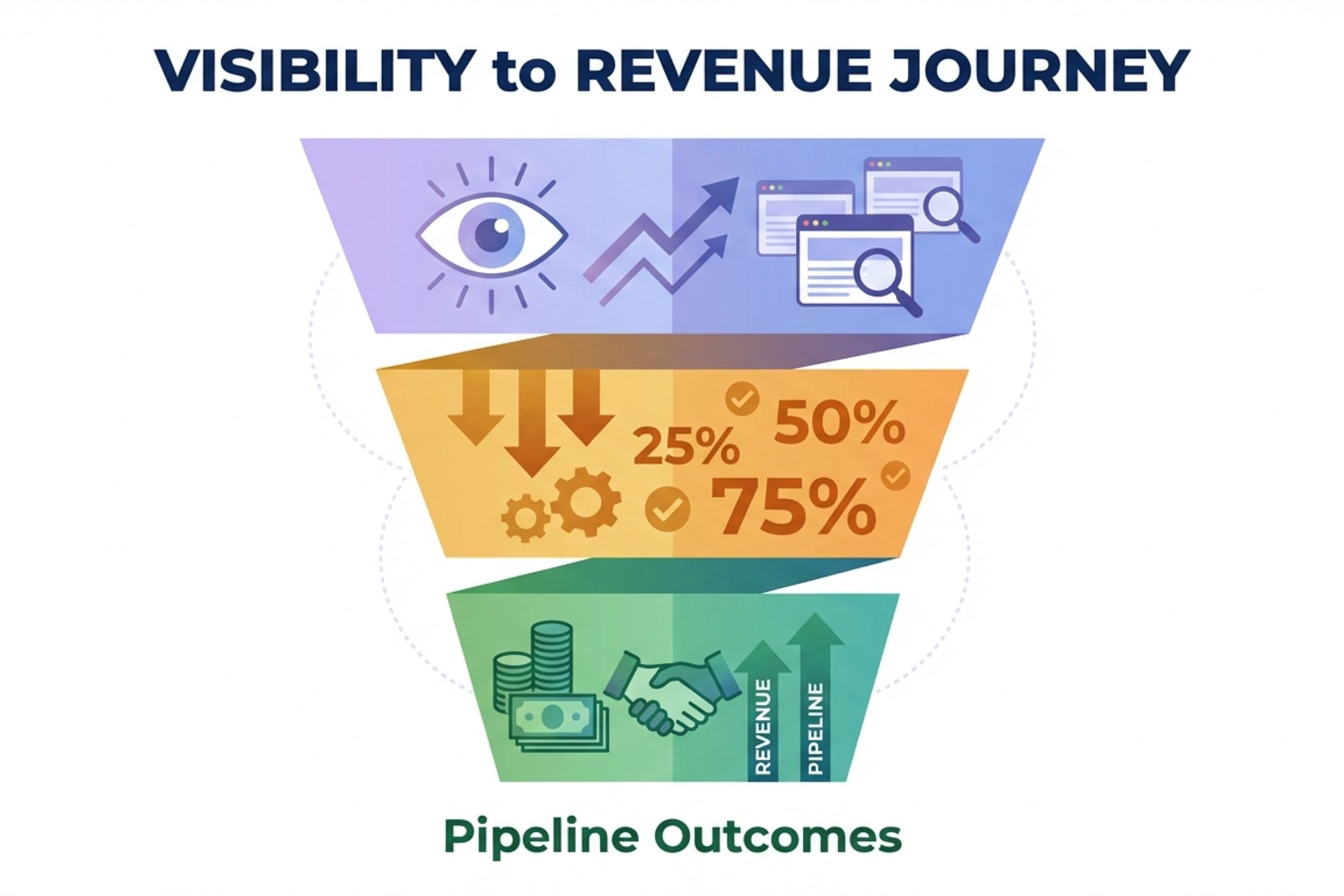

A visibility-to-pipeline scorecard is a concise dashboard that links attention to revenue. It shows inputs, conversions, and outcomes.

The scorecard tracks three layers. Layer 1 captures leading indicators like website sessions, brand searches, content engagement, and demo requests. Layer 2 captures conversion rates between funnel stages. Layer 3 captures revenue outcomes like pipeline value, closed-won revenue, and CAC payback period.

Each metric includes current value, prior period, change percentage, target, and status. Simple red, yellow, and green statuses guide decisions quickly. The format removes guesswork and creates a shared language across marketing, sales, and finance.

To build trust, the scorecard uses consistent definitions. For example, a Marketing Qualified Lead (MQL) is a contact that meets a clear fit and intent threshold. An Opportunity is a sales-accepted deal in your CRM. Consistency is credibility.

The 3-Layer Scorecard Framework That Connects Marketing to Revenue

The scorecard uses three layers to connect marketing activity to revenue. Each layer answers a different executive question.

Layer 1 answers, “Are we creating market attention?” Layer 2 answers, “Are we converting attention into pipeline?” Layer 3 answers, “Are we creating profitable growth?” You need all three views to earn executive confidence.

This structure works because it respects time lags. Visibility moves first. Conversions translate intent. Revenue closes last. When you show the chain weekly or monthly, leaders see momentum and risk early. That prevents reactive budget cuts and rushed campaigns.

Use one page. Keep math simple. Report trends, not noise. Your CEO wants a forecastable machine, not a perfect lab.

Layer 1: Leading Indicators (Visibility Metrics)

Leading indicators are early signals that your market sees and responds to your brand. They move faster than revenue.

Track four core visibility metrics. Website sessions show reach. Content engagement shows relevance. Branded searches show awareness. Demo or trial requests show bottom-funnel intent. These inputs tell you if demand is expanding or stalling.

Define each source. Sessions come from analytics. Engagement includes time on page, scroll depth, and click-through rates. Branded searches come from Google Search Console. Demo requests come from forms, chat, or product signups. Keep sources consistent week to week.

Set crisp targets. For early-stage SaaS, aim for session growth of 10–20% month over month, a 50%+ scroll depth on key pages, rising brand search volume, and a steady flow of high-intent requests. Leading indicators guide fast adjustments before revenue dips.

Layer 2: Pipeline Conversion Metrics

Pipeline conversion metrics translate attention into qualified sales motion. They reveal friction and leverage points.

Measure these rates: visitor-to-lead, lead-to-opportunity, and opportunity-to-close. Add Sales Accepted Lead (SAL) rate if you use it. Each rate isolates a stage so you can diagnose issues and prioritize fixes.

Calculate simply. Visitor-to-lead = leads ÷ sessions. Lead-to-opportunity = opportunities ÷ leads. Opportunity-to-close = closed-won deals ÷ opportunities. Report to one decimal place. Small teams need clarity, not precision theater.

Target ranges for early SaaS are 1–3% visitor-to-lead, 10–20% lead-to-opportunity, and 15–30% opportunity-to-close. Movement within these bands changes pipeline quickly. Improving a mid-funnel rate by two points often beats chasing more traffic.

Layer 3: Lagging Indicators (Revenue Outcomes)

Lagging indicators are the financial outcomes leadership funds. They prove the model works at the bank account level.

Track three outcomes. Pipeline value shows near-term revenue potential. Closed-won revenue proves realized value. CAC payback period shows efficiency, defined as time to recover acquisition cost from gross margin. These metrics calm skepticism and unlock budget.

Calculate pipeline value by multiplying opportunities by average deal size and probability weighting if used. Calculate payback as CAC ÷ monthly gross margin per customer. For example, $1,500 CAC and $300 monthly gross margin equals a 5-month payback.

Use thresholds. Many SaaS CEOs expect payback under 12 months, with sub-6 months for SMB motion. Reporting these outcomes monthly creates discipline and predictable forecasts.

How to Calculate Each Metric (With Real SaaS Examples)

Use simple formulas with real numbers so everyone agrees on the math. Keep it consistent across reports.

Example: You received 10,000 sessions in May. Visitor-to-lead conversion is 2%. That yields 200 leads. Lead-to-opportunity is 10%. That yields 20 opportunities. Average deal size is $10,000. Your pipeline value is $200,000. Opportunity-to-close is 25%. Expected closed-won is five deals, or $50,000 this cycle.

Example: CAC is $1,200 including media and tools. Monthly gross margin per customer is $300. CAC payback period is four months. Present both the number and trend versus last month to show improvement.

List each formula on your scorecard footer. Consistent formulas stop debates and focus the team on improving rates, not arguing definitions.

Calculating Visitor-to-Lead Conversion Rate

Visitor-to-lead conversion rate is the percentage of sessions that become leads. It measures top-of-funnel effectiveness.

Formula: Visitor-to-lead rate = total leads ÷ total sessions. Example: 150 leads from 7,500 sessions equals 2.0%. Use sessions, not users, to avoid identity issues across devices. Track this rate by key pages, sources, and campaigns to find leverage points.

Improve this rate with aligned intent. Match search terms to page promises. Use primary CTAs above the fold and proof near the form. Add a short form for trials and a longer form for enterprise demos. Test one variable per week and log changes in your scorecard.

Benchmark early-stage SaaS at 1–3%. If you are below 1%, fix offer clarity and page speed. If you are above 3%, add qualified traffic before over-optimizing microcopy.

Calculating Pipeline Value from Traffic

Pipeline value from traffic is the dollar value forecast from current opportunities. It connects traffic volume to revenue potential.

Formula chain: pipeline = sessions × visitor-to-lead × lead-to-opportunity × average deal size. Example: 10,000 × 2% × 10% × $10,000 = $200,000. This shows how small rate changes compound into big dollars.

Use probability weighting by stage if your CRM supports it. For example, apply 50% at proposal and 80% at verbal commit. Show both gross pipeline and weighted pipeline so finance can model cash more accurately.

Show sensitivity. A one-point increase in lead-to-opportunity from 10% to 11% adds $20,000 to pipeline in the example. This proves why mid-funnel optimization often beats buying more traffic.

Calculating CAC Payback Period

CAC payback period is the time to recover customer acquisition cost from gross margin. It shows efficiency and risk.

Formula: Payback months = CAC ÷ monthly gross margin per account. Example: CAC $1,500 and $250 monthly gross margin equals six months. If churn reduces lifetime, increase urgency to improve payback or shift to higher LTV segments.

Improve payback in three ways. Lower CAC with better targeting and organic channels. Raise gross margin with pricing and cost control. Increase expansion revenue with onboarding and success motions. Track all three levers in your notes column.

Executives love payback because it ties acquisition to cash. A sub-12-month payback with healthy retention earns more budget without debate.

How to Handle Attribution Without a Data Science Team

Use a simple, consistent attribution model and move on. Perfect attribution is unnecessary for small teams.

Pick first-touch or last-touch and document the rule. Apply it across ads, content, and partnerships. Add a self-reported attribution field on the demo form for qualitative context. Use both views to steer budget without analysis paralysis.

First-touch shows demand creation. Last-touch shows demand capture. Use first-touch to fund awareness programs. Use last-touch to optimize channels that close deals. The key is consistency over time so trends are trusted.

Tag every link with UTM parameters. Track leads and opportunities in your CRM. Review channel-level pipeline monthly. This is enough to make good decisions and earn executive confidence.

First-Touch vs. Last-Touch: Which Model to Use

Choose first-touch when you need to prove which channels create net-new demand. Choose last-touch to optimize conversions.

First-touch attribution credits the first channel that brought a contact to your brand. It is ideal for content, community, and brand programs where the goal is awareness and future pipeline. It shows creation, not just capture.

Last-touch attribution credits the final channel before a conversion or opportunity. It is ideal for paid search, comparisons pages, and retargeting where the goal is immediate action. It shows capture, not origin.

Use both for different questions, but report one primary model in your scorecard. Note exceptions in a comments column. Consistency builds trust faster than a complex multi-touch model you cannot maintain.

Simple Attribution Tools for Resource-Constrained Teams

You can run attribution with basic tools today. You need UTMs, a CRM, and a spreadsheet view.

Use UTM parameters on every link: source, medium, campaign, content. Google Analytics 4 captures sessions. Google Search Console shows branded and non-branded queries. Your CRM (HubSpot, Pipedrive, or similar) owns leads, opportunities, and revenue.

Add a required self-reported attribution field like “How did you first hear about us?” in demo forms. It captures podcasts, communities, and word-of-mouth missed by click tracking. Reconcile qualitative and quantitative data monthly.

Roll up results in a simple sheet or Agent Berlin’s automated scorecard. Show channel-level leads, opportunities, pipeline, and payback. Keep the stack light so you actually update it.

Building Your Scorecard: Template Structure and Update Frequency

Build a one-page scorecard with clear fields, simple visuals, and fixed update cadence. Make it your single source of truth.

Organize by the three layers: leading indicators, conversion rates, and outcomes. For each metric, show current value, previous period, change percentage, target, and status color. Add owner and notes columns for accountability and context.

Create a data tab for raw exports from GA4, Search Console, ad platforms, and your CRM. Use simple formulas to populate the scorecard view. Lock definitions at the top. Consistency beats complexity week after week.

Update cadence should match your sales cycle. Weekly for SMB cycles under 45 days. Monthly for mid-market or enterprise. Present on the same day and time to build rhythm.

What Columns to Include in Your Scorecard

Use a consistent table so executives can scan in seconds. Keep columns tight and purposeful.

Include these columns: Metric name, Definition, Source, Current value, Previous period, Change %, Target, Status (green/yellow/red), Owner, and Notes. Add a Trend arrow to signal direction at a glance. This format answers the what, where, and who in one view.

Color rules: Green = at or above target. Yellow = within 10% of target. Red = below 90% of target. Document thresholds next to the legend. Decision speed increases when colors are unambiguous.

Freeze the header row and sort by business priority. Revenue outcomes first, then conversions, then leading indicators. This order aligns the team to pipeline every time.

How Often to Update and Present Your Metrics

Update your scorecard on a fixed cadence that matches deal velocity. Present it live and keep the meeting short.

For SMB motions with 14–45 day cycles, update weekly and present in 15 minutes. For mid-market motions with 60–120 day cycles, update monthly and present in 30 minutes. Consistency builds trust and trend awareness.

Share the scorecard link 24 hours before the meeting. Start with outcomes, then conversions, then inputs. End with three actions and one owner per action. Skip narrative slides. Let the numbers talk and the plan follow.

Archive each version. A simple tab per week or month shows progress and seasonality. This history turns one-off data into a learning system.

Visual Presentation: Traffic Lights vs. Complex Dashboards

Use traffic lights and arrows. Avoid complex dashboards. Executives decide faster with simple visuals tied to targets.

Color status communicates performance instantly. Arrows communicate direction. A single page with both beats ten widget screens. Each extra chart dilutes the narrative and slows decisions.

Show only metrics you are willing to act on this period. Hide vanity metrics that do not change resourcing or tactics. If a number does not trigger a decision, remove it from the executive view.

If you want a deeper cut, keep a second analyst tab. Present the executive page first. Then answer questions with the backup. This protects clarity while respecting curiosity.

How to Interpret Results and Take Action

Interpret the three layers together. Then choose one focused action per bottleneck. Action turns reports into revenue.

Ask three questions. Are inputs growing? Are conversion rates healthy? Are revenue outcomes on target? The pattern points to the bottleneck. Fix one constraint at a time to avoid diluted effort and muddy results.

Use simple playbooks. If visibility is high but pipeline is low, fix conversion. If pipeline is strong but visibility is falling, protect the future. If both are weak, rebuild top-of-funnel. The next sections detail exact moves.

Log your decisions and expected impact in the notes column. Review outcome changes on the next cadence. This creates an operating loop, not a report museum.

Scenario 1: High Visibility, Low Pipeline (Conversion Problem)

When visibility is high but pipeline is low, you have a conversion problem. Fix friction and intent alignment fast.

Start at visitor-to-lead. Improve offer clarity and page speed. Add proof near CTAs: logos, outcomes, and case stats. Reduce form fields from seven to four. Route high-intent leads to instant booking. These tweaks typically raise conversion by 20–50% in weeks.

Next, tighten lead-to-opportunity. Align MQL criteria with sales. Add a 24-hour SLA for outreach. Use a two-step nurture: value email within one hour, rep outreach within 24 hours. Measure reply rates and meetings booked.

Finally, review targeting. Cut unqualified traffic sources. Shift budget to keywords and audiences that match your ICP. A one-point increase in lead-to-opportunity often adds more pipeline than 20% more traffic.

Scenario 2: Strong Pipeline, Declining Visibility (Sustainability Risk)

When pipeline is strong but visibility declines, you have a sustainability risk. Protect the future while closing today.

Stabilize leading indicators. Publish two optimized pieces weekly targeting problem-aware queries. Refresh top performers. Launch a lightweight webinar or live demo series. Increase branded search by promoting customer stories and PR mentions.

Safeguard conversion assets. Keep pricing, comparison, and demo pages fast and updated. Maintain retargeting to recapture warm visitors. Preserve last-touch channels while rebuilding discovery.

Set a 60-day recovery plan. Target 10–20% growth in sessions and steady demo requests. Show the CEO the plan, the content calendar, and the expected pipeline lag. This keeps confidence high while you rebuild demand.

Scenario 3: Weak Visibility and Pipeline (Top-of-Funnel Issue)

When both visibility and pipeline are weak, rebuild the top of the funnel. Create momentum with focused, high-intent programs.

Pick one ICP and one pain. Launch a three-piece content spine: comparison guide, ROI calculator, and 10-step playbook. Promote with targeted search ads and partner newsletters. Add a strong demo or trial CTA on each asset.

Stand up a weekly event or office hours. Collect questions and convert them into content. Activate founders and PMs on LinkedIn for credibility. Seed early reviews on G2 or Capterra to build trust.

Set modest 60-day targets. Aim for 5,000 sessions, 1–2% visitor-to-lead, and five qualified opportunities. Report weekly progress and celebrate early wins to keep morale and budget intact.

Answering the CEO's Toughest Objections

Tackle objections head-on with clear math and timeframes. Confidence comes from consistent, compounding results.

Objection one is scale. Answer with sensitivity analysis that shows how a one-point conversion gain adds real dollars. Objection two is speed. Answer with a timeline that pairs weekly leading indicators with a 6–12 week revenue lag. Objection three is causality. Answer with consistent attribution rules and side-by-side cohorts.

Bring proof. Show last quarter’s trend lines and the three actions taken. Connect each action to a metric movement. Executives trust operators who predict, act, and report outcomes on a cadence.

Close with budget impact. “At sub-6-month payback, every $1 invested in this channel returns $2 in year one.” That line earns approvals.

"These Numbers Are Too Small to Matter"

Small numbers compound fast when you move conversion rates. Show the math and the upside clearly.

Example: You have 5,000 sessions at a 1.5% visitor-to-lead rate. That is 75 leads. Increase the rate to 2.5% by fixing forms and offers. That becomes 125 leads. At a 15% lead-to-opportunity rate and $10,000 deal size, pipeline jumps from $112,500 to $187,500. That is material.

Run a sensitivity table with three levers: traffic, mid-funnel rate, and deal size. Show the CEO which lever creates the most pipeline per effort hour. Mid-funnel wins often.

End with the rule: “Improving conversion by one point beats buying 20% more traffic.” It is true in most early-stage funnels.

"This Takes Too Long to Show Results"

You can show momentum weekly while revenue lags by 6–12 weeks. Report leading indicators and set expectations.

Publish the cadence upfront. Week 1–2: visibility lifts. Week 3–6: conversion rates improve. Week 6–12: pipeline and revenue materialize. Share a simple timeline on your scorecard header and stick to it.

Use fast experiments. Test a headline, a CTA, or a proof block each week. Log the change and the result. Executives see action and movement, not waiting and hoping.

Pair quick wins with durable plays. SEO and brand build compounding returns. Paid demand accelerates learning. The mix shows progress now and stability later.

"How Do I Know Marketing Caused This?"

You show causality with consistency, cohorts, and clear rules. Perfection is unnecessary to make good decisions.

Set one primary attribution model and apply it every period. Add self-reported attribution to capture dark social and word-of-mouth. When both point to the same channel, the case is strong.

Run simple cohorts. Compare periods before and after a campaign launch for the same segment. Show changes in leads, opportunities, and payback. Control for seasonality where possible by comparing year-over-year.

Document actions on the scorecard. “Launched comparison page on May 7. Lead-to-opportunity up two points by May 28.” Executives trust operators who log cause and effect.

Realistic Benchmarks for Early-Stage SaaS Companies

Use realistic ranges so you target improvement, not perfection. Benchmarks guide, they do not excuse.

Top-of-funnel: visitor-to-lead 1–3%, email sign-up rate 1–5%, demo request rate 0.3–1.0% of sessions. Mid-funnel: lead-to-opportunity 10–20%, SAL acceptance 70–90%. Bottom-of-funnel: opportunity-to-close 15–30% for SMB ACVs ($5–$20k), 10–20% for mid-market ACVs ($20–$80k).

Outcomes: average deal size $5,000–$25,000 for SMB SaaS, payback under 12 months with a target under six months as you scale. Churn under 3% monthly for SMB is healthy. Document your own baselines and track deltas.

Benchmarks set context in executive meetings. Trends and improvements win budget more than absolute numbers.

Your Next Steps: Implementing the Scorecard This Week

Build the scorecard, run the math, and share it with your CEO. Start simple and iterate.

Day 1: list metrics, definitions, and sources. Create columns for current, previous, change %, target, status, owner, and notes. Add your three-layer structure. Day 2: connect GA4, Search Console, and CRM exports. Fill in last period and current period. Day 3: present the scorecard and agree on three actions.

Update on a fixed cadence. Log every change and expected impact. Review outcomes and adjust levers. If you want automation and faster learning loops, connect an AI-driven platform like Agent Berlin to collect signals and execute optimizations.

Keep the goal clear: a scorecard the CEO believes because it ties visibility to pipeline with simple, repeatable math.

Stay ahead of the AI search revolution

LLM-based search is transforming user behavior rapidly. Subscribe to get exclusive insights from our experiments, discoveries, and strategies that keep you competitive in this evolving landscape.

No spam. Unsubscribe anytime. Updates only when we have valuable insights to share.